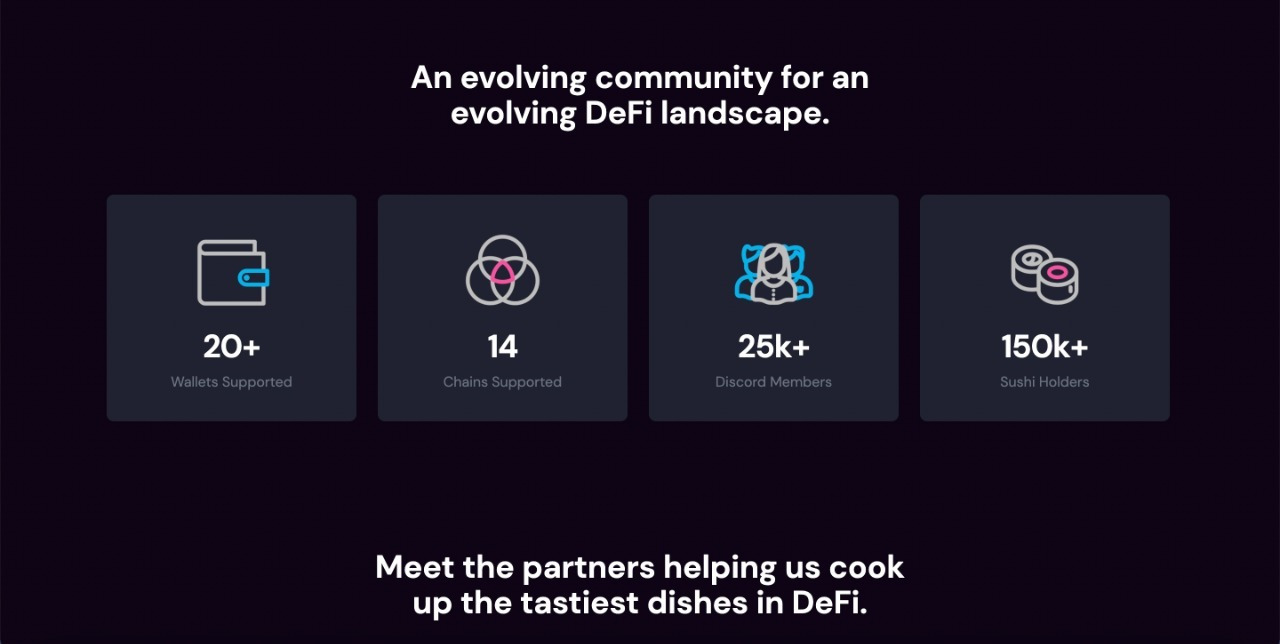

Understanding SushiSwap To understand SUSHI, we first need to come to grips with decentralized exchanges and how they work. Without wanting to overwhelm you with technical terms, it would be good to know the answers to these three questions:What's a decentralized exchange (DEX)? A DEX is a cryptocurrency exchange where users can swap coins directly with each other. Unlike a centralized Sushi exchange, there's no third party sitting in the middle guaranteeing the trade. These exchanges use small pieces of code called smart contracts to ensure the transactions go through smoothly.What's an automated market maker (AMM)? A traditional exchange has order books with buyers and sellers. In contrast, SushiSwap uses an AMM to make it possible for its users to trade. The AMM creates what's called a "liquidity pool" of tokens and uses complex formulas and algorithms to keep the prices in line with the market.What's a liquidity pool? A liquidity pool means traders don't need a buyer or seller because they can exchange tokens with the pool. Each pool is made up of pairs of tokens that might be traded -- for example, SushiSwap and Ethereum. Investors might contribute SUSHI and ETH to the pool. They get paid a percentage of any trading fees. So if somebody swapped SUSHI for ETH, the people providing liquidity would benefit.Jargon over! It may feel like a lot to get your head around, but if you're buying SUSHI, this will help you get the most out of your investment.SushiSwap basicsWhat it does: SUSHI is the governance token on the SushiSwap exchange.Date launched: August 2020.Market cap: $1 billion (CoinMarketCap, July 2021).Availability: Available on several major U.S. cryptocurrency exchanges, including Coinbase and Binance.US.Should I buy it?If you're considering buying SUSHI, you need to be comfortable with volatility and risk. All cryptocurrencies are risky investments, but smaller coins like SUSHI are even more unpredictable. They are extremely volatile, which means you may see huge gains, but you also need to be ready for huge potential losses. Here are a few other factors to bear in mind.1. Passive incomeOne of the attractive features of SUSHI and other DEX tokens is that you can make them work for you. For example, investors can stake SUSHI -- at the time of writing the APR is 3.46%, but it varies from day to day. Staking ties up your coins and in return you get paid a percentage of the transaction fees.More experienced investors might want to add liquidity to the liquidity pools, but this carries more risk. If one coin in the pair dramatically outperforms the other, it can lead to something called impermanent loss. The investor might not be able to realize the same profits from the price increase as they would if they'd simply held the coin.2. CompetitionSUSHI is not the only DEX token on the market, and it is hard to see which one (if any) will come out on top. Each DEX offers different features, different ways to earn interest, and different interest rates. That said, just as there are several centralized cryptocurrency exchanges, there's no reason to think there's only room for one DEX.Before you buy any DEX token you need to decide if you plan to go further into the world of decentralized finance (DeFi) by staking or adding liquidity. If that's your plan, then spend some time exploring the different exchanges to decide which one suits you. That's the best place to start -- and the best token to buy first.3. DeFi regulationDeFi is one area of cryptocurrency that has authorities around the world worried. The concern is that they are providing banking services without the consumer protections and regulations that exist for banks.For example, if the SushiSwap platform failed or was hacked, your SUSHI tokens could suddenly be worth nothing. If that money had been in a bank account, you'd be protected by FDIC insurance.In Europe, the Basel Committee on Banking Supervision has proposed that DeFi tokens be treated as high-risk investments. If the proposals are implemented, they would require any financial institutions holding these tokens for clients to hold enough capital to completely cover losses if the asset lost all its value. So for every $100 of SUSHI, an exchange would have to have $100 in traditional money.It isn't clear how regulation will unfold, but if authorities clamp down on decentralized exchanges, that's sure to have an impact on SUSHI's price.Bottom lineSushiSwap is a popular decentralized exchange, and the SUSHI token has performed well since its launch. If you're considering buying it, it would be good to pay attention to similar tokens in the DeFi space and read up on possible regulatory changes. A solid understanding of decentralized finance will help you to get the most out of the token.Buy and sell cryptocurrencies on an expert-picked Sushi exchange There are hundreds of platforms around the world that are waiting to give you access to thousands of cryptocurrencies. And to find the one that's right for you, you'll need to decide what features matter most to you.To help you get started, our independent experts have sifted through the options to bring you some of our best cryptocurrency exchanges for 2021. Check out the list here and get started on your crypto journey, today.